UGRU CRM for Financial Advisors Features & Benefits

CRM

- Contact Management. UGRU CRM for Financial Advisors makes it easy to capture and organize all of your detailed information for every prospect, client, vendor, and associate, setup follow-up calls and appointments, log emails and detailed notes, setup referrals, and attach documents.

-

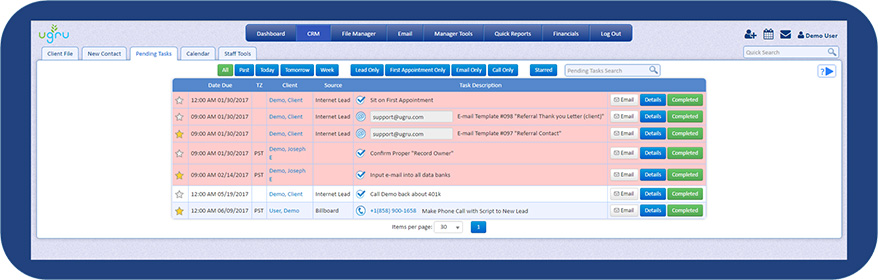

Task Management. Manage and track each task through its lifecycle. This ensures the team will complete client service tasks and sales fulfillment items.

- Email Segregation. Filter for email tasks in Pending actions.

- Call Segregation. Filter for call tasks in Pending actions.

- Task Segregation. Filters for Tasks.

- Past Due Segregation. Filter for tasks due the day before today or previously. Tasks then are marked in a salmon color as soon as they are past due.

- Today/Tomorrow/Week Segregation. Filter tasks by today, tomorrow, or the next 7 days.

- Lead Only. Filter tasks to include work on only contacts classified as “Lead” in Lead Status.

- By Importance. If a task is deemed “important,” then you can add a Star next to it. You can also filter by Starred tasks.

- Assign Task to Calendar. Task gets automatically created as a calendar event in the CRM calendar.

- Users Can Play Multiple Roles. Each user can have up to three roles that tasks will default to per the workflows.

-

Data Management. System for creating and managing data like contact records and notes in your database. This provides a way to create, retrieve, update, and manage all contact data for the entire team.

- Validation. UGRU CRM for Financial Advisors allows you to setup mandatory lookups to ensure everyone uses the same pre-defined data per field (NI instead of Not Interested, NV instead of Nevada, etc.). This ensures your data is always consistent.

- Duplicate Checking. Checks for duplicate records while entering or during import—will also allow you to override and add a duplicate if you chose. Ensures your database is not filled with identical contacts.

- Import Mapping. You can map data fields from CSV files to the UGRU CRM to ensure all imports come into the correct field.

- Mass Import. You can import multiple contacts and organizations into UGRU CRM for Financial Advisors at once from a CSV file format. Saves time and eliminates the cost of data entry.

- Mass Export. Export multiple contacts out of the UGRU CRM system into CSV.

- Saved Searches. You can setup save contact database searches for re-use later—saving you from having to re-construct a complex search routine every time.

- Convert Individual to Entity. Change a contact record from an individual to an entity. No data is lost during the conversion and the process takes seconds.

- Swap Primary Contacts. Switch a primary contact from one spouse to the other. It is helpful if a client is deceased.

- Contact Tagging System. You can create tags for contact records called “keywords” to reference in database searches to find specific contacts.

-

Lead Management. System for managing information to take leads from initial contact to becoming a client. This helps the sales team close more deals and ensure none of the leads are overlooked.

- Lead Source. Indicates where the lead originated from. Helps you to determine which lead campaigns are most successful.

- Lead Web Capture. Online form that automatically enters your contact into the CRM. Eliminates manual entry.

- Lead Routing. Automatically routes leads to your sales or account team (by territory, last lead in, type, etc.)—can also be setup as a round robin (to ensure everyone is given leads evenly).

- Lead Mass Reassignment. Transfer tasks and leads in bulk from one user to another—especially important if you re-org your sales team, or a team member goes on vacation.

- Lead Referral Tracking. Tracks where your leads came from so it is easy to see which referrer is helping the most, and so you can also link the relationship (John sent you a lead, you can use John’s name as a reference when calling).

- Lead Segmentation. Organize your leads by similar needs, interests, market characteristics etc..., to measure your marketing efforts from email open rates to customer loyalty.

- Territory Management. Allows you to assign accounts to individuals, groups or territories then easily re-align accounts, pending appointments, task, calendar events, and status to other team members or groups as needed.

- Interaction Tracking. You can track all emails and outbound phone calls to any contact record. This gives the sales team clarity on where each prospect/client is in their respective service or sales cycle.

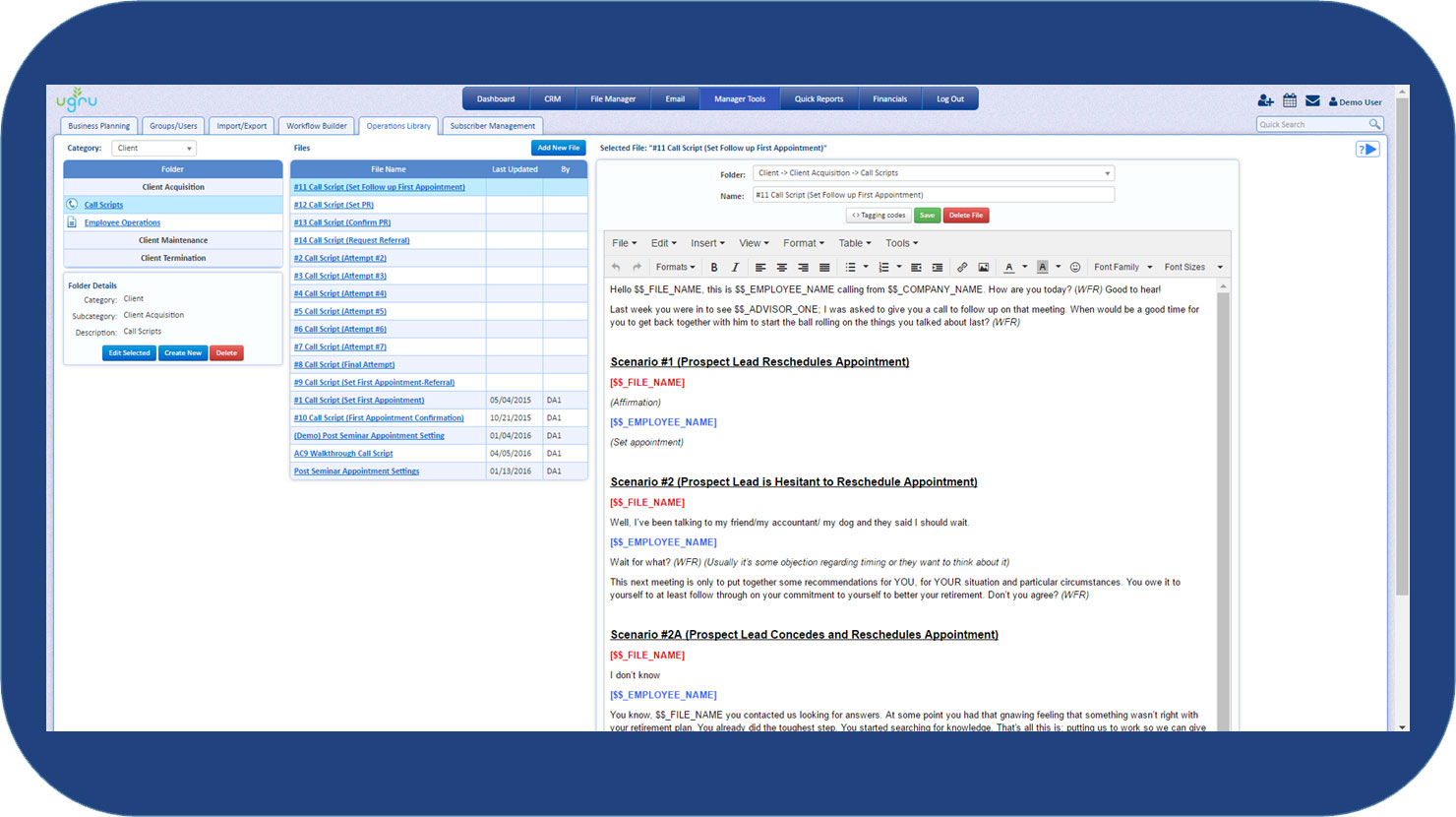

- On Demand Call Scripts. Custom call scripts that can be attached to any task or contact. Helps your team to capture the most effective dialogues, be more consistent and start selling sooner without having to memorize product or sales information.

- Team Selling. Great for when you have a team member who pre-qualifies an account and then transfers the prospect to the closer, or a closed deal then gets transferred to support for setup.

- Sales Forecasting and Pipeline. UGRU CRM for Financial Advisors tracks your contacts, where they are in the sales cycle, the size of the opportunity, whether it is single or recurring revenues, separates AUM and fixed commission opportunities, and calculates the chance of close—making it easy to forecast your sales and cash flow.

- Outbound Phone Automation. Easily connect your VOIP system to call prospects or accounts with a single click, create time-stamped notes, and enable customized call scripts with a consistent sale’s message for a higher chance of closing.

Marketing

- Email.

- Built-in email Included. UGRU CRM for Financial Advisors includes a native email app that ties sent and received emails to your account within the CRM. Integrated with Outlook. Email data can be exported/imported or linked to and from Outlook (in case you don’t want to use the built-in email).

- Mass email. You can send up to 5,000 emails per day, up to 150,000 emails per month. You can also pay $0.09 per 1000 emails afterward until the next month.

- For Audits. All inbound/outbound emails are archived in PDF format as retrievable reports. This fulfills FINRA requirements when audits or compliance challenges arise (required at least every two years).

- Detailed E-mail Search. Granular search within emails for key words (such as “promised me”) so you can quickly find a contact and what you said—helpful to quickly resolve conflict or compliance inquiries.

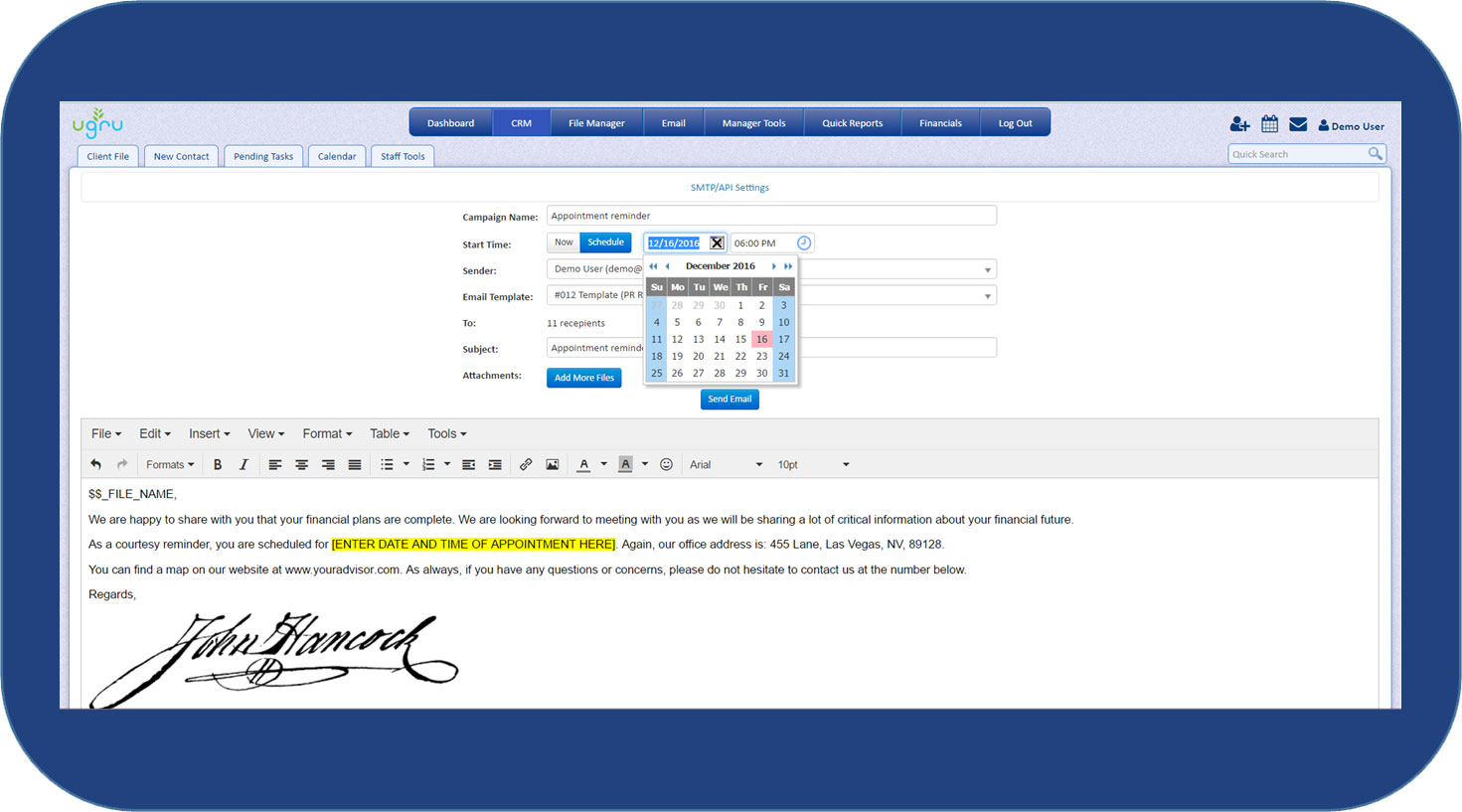

- Email and Mail merge wizards. You can create email campaigns, change who it was sent from, schedule date and time and more, and define the target prospect—makes it easy and automatic.

- Drip Campaigns. Send scheduled emails to any individual or group in your system. This helps you stay in contact with prospects that may not be ready to buy, so they will remember you and cycle back around when ready to purchase.

- Campaign Analytics. Gain valuable insight about open, click thru, bounce rates on your mass email campaigns. Allows you to quantify the performance of your campaign messages to improve ROI.

- Workflow Automation. Create your own or edit existing workflow templates to easily manage all Client or Staff Acquisition, Maintenance or Termination tasks Ensures operational consistency so your clients are never forgotten.

Reporting

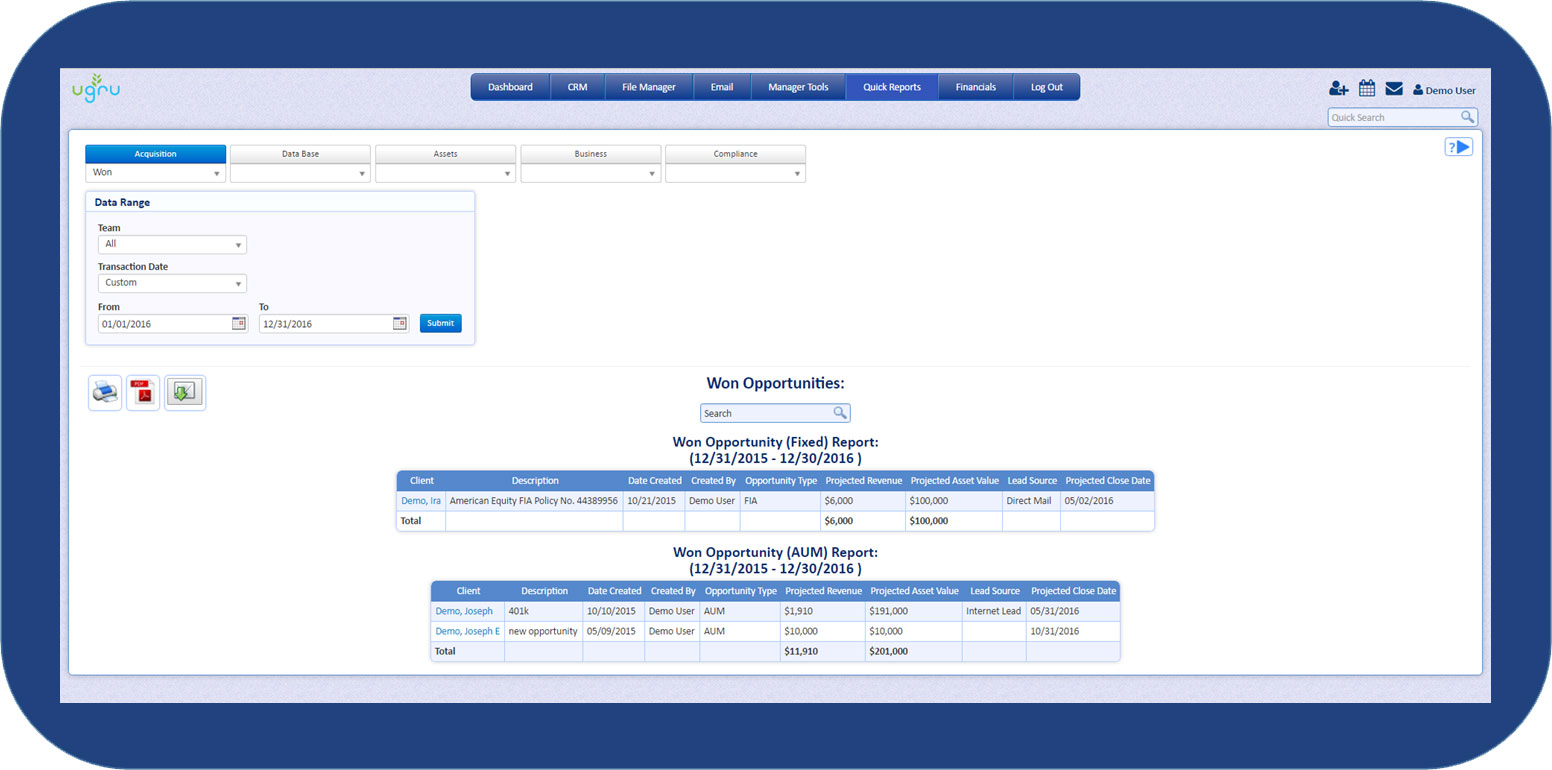

- Quick Reports. Acquisition, Data Base, Assets, Business and Compliance reports which show the most often needed information specific to financial advisors - accessible by only a couple clicks.

- Custom Reports. Easy to create reports (that can be saved) using drop down menus instead of having to create rules.

- Key Performance Indicators (KPI's). Sales metrics specific to financial advisory practices that define and measure progress toward your organizational goals.

- Dashboards. Gauges that display KPI metrics so you can see your organizations REAL time performance compared to pre-set goals at a glance.

- Sales Forecasting. Allows you to see the value of your opportunities to forecast upcoming sales—critical to managing your businesses cash flow.

- Pipeline. Visual representation of your sales process from start to finish. Helpful in showing exactly where you make the most/least money, generate the most/least amount of leads, and where deals are potentially lost most often.

- Campaign ROI Reporting. This allows you to A/B split test your campaigns so you can find out which messages generate the most leads and sales.

- Employee Productivity. A report that tracks tasks and percent completion. Helps you see if a team member is using the system correctly, completing projects as expected and any areas your team may need training or follow up.

- Employee Pending Tasks. This shows all tasks assigned to each of your staff by client and the corresponding task as well as whether the task is overdue or not. Helps you to quickly identify bottlenecks, reassign tasks or modify and duties.

- Email Analytics. This report shows the campaign name, date started, number of recipients, delivered, pending, opened, clicked, bounced, unsubscribed, complaints and the status of the email campaign. This gives insight into the effectiveness of your marketing message.

- Email Report—for Regulations. A date range report by user showing number of emails received, sent and deleted which are archived and made available via PDF. It also allows you to search all emails that contain specific words–critical for control and audit requests as required by regulation.

- Quick Report Export. Click an icon to immediately print, save as PDF or CSV and email (permission based) as needed. This cuts time to share and compare requested reports.

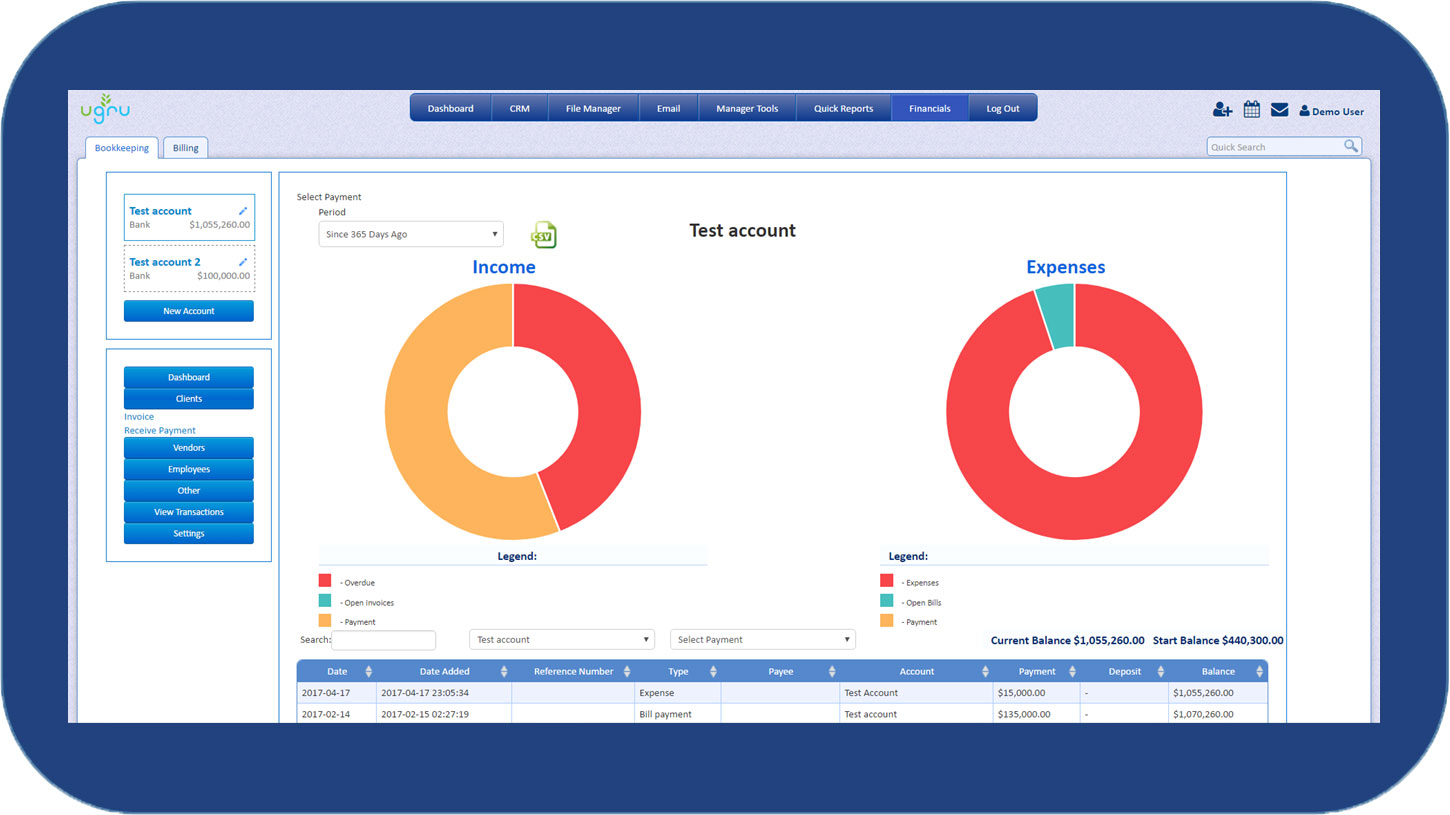

Accounting

- Full-Featured Accounting. It’s Integrated with the CRM for Financial Advisors and drives the financial dashboard. Includes:

- Uses a QuickBooks®- like interface. (Designed by QuickBooks® consultants making it familiar to use for existing QuickBooks users).

- Accounts Receivable. Track and mark paid all money owed to your practice. This is great for advisors that charge hourly or bill clients for planning work.

- Accounts Payable. Track and mark money owed to other vendors and businesses.

- General Ledger. Record used to sort and store balance sheets and income statements.

- Accrual or Cash Accounting. You can decide which method you prefer.

- Invoicing. You can select any contact in the UGRU CRM to send an invoice to. Invoicing is fast, automatically recorded in your bookkeeping ledger, and integrated with your CRM contacts.

- Employee Payroll. Keep track of each employee’s payroll history, track hours, and total payroll. It’s an easy way to manage simple payroll functions in-house.

- Unlimited Accounts. In UGRU CRM for Financial advisors, you can add multiple bank and credit card accounts in the Accounting section at no additional charge. This saves you money when you need to add an account for payroll or a separate entity for your accounting practice or fixed life insurance production.

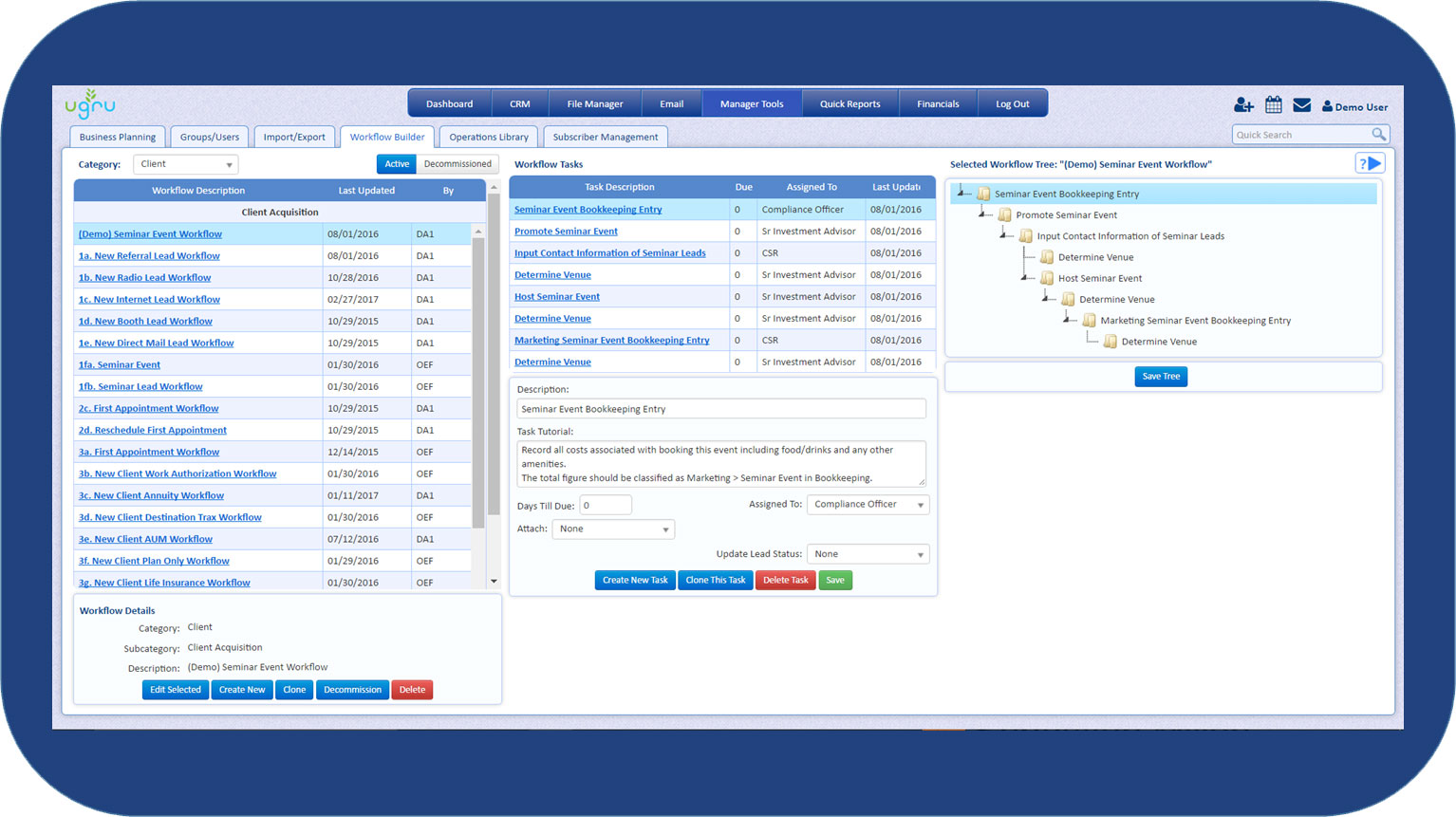

Business Management

- Workflow Builder. UGRU CRM for Financial Advisors includes over 40 pre-defined best practices that can be customized for your own team. Makes it easier to train and ensures everyone is following uniform best-processes for onboarding new clients and employees, handling payroll, beneficiary changes, HR hire and fire, portfolio re-allocations, annual client reviews, following FINRA regulations, etc.

- Linear workflows. Allows you to edit existing or build simple workflows-- helpful when you want to quickly build processes that might not be permanent.

- "If, Then" Logic Workflows. Helps you build “If, Then” workflows where a given task has multiple next step options upon completion. This helps you build permanent processes in your practice.

- Trigger Automation. Setup a task in a workflow that automatically triggers the completion of a next step when the previous task is finished. This reduces unnecessary manual work.

- "Jump to" Tasks. Provides the ability to jump to any future task in a live workflow and skip the tasks in between. For example, if you already know your client won’t qualify for an IRA, you can bypass the worksheet and all the steps and select “no”.

- Workflow Task Synced to Calendar.Allows you to setup a calendar follow-up event from within the workflow—without having to exit the workflow to setup an appointment, then return to the workflow—saving you steps and streamlining a common process.

- Pre-Built Workflows. UGRU CRM for Financial Advisors provides over 40 pre-built best-practice workflows (many that are specific to financial practices) for most all acquisition, maintenance and termination processes regarding your clients and staff. Saves you time and effort to create process from scratch.

- Business Planning. Allows you to plan the future of your business with a “Pro forma application” and “Gauge Calibration application” which is tracked on your dashboard.

- Dashboard. The main Dashboard includes gauges that shows your revenue, expense, profit/loss, sales pipeline and other KPI’s. You can click each gauge to drill down to the details—providing a macro and micro view of your business performance.

- Document Management. Each contact in the system has an independent document vault for storing, managing, searching and sharing documents (all major file types: PDF, Word, Excel, JPG, etc.). Ensures all standard and client documents are easily found or tied to an account so nothing gets lost.

- Operations Library. Stores all your general call scripts, presentations, portfolio agreements, email templates, marketing slicks, etc. in a central document library. Permissions regulate who can view and access each document.

- Calendar. Allows you to calendar events without leaving the system, receive reminders and updates on the road via the UGRU CRM for Financial Advisors mobile app, invite others to an event via email and set up recurring events.

- Team Calendar. Shows the schedules for each member of your team. Helps you coordinate group meetings, assign activities to other members, and balance workloads.

- Pre-Designed Collateral. UGRU CRM for Financial Advisors includes hundreds of pre-designed PowerPoint and Word templates, workflows, e-mail templates, call scripts, videos and HR documents to jumpstart your practice.

- Message Board. Allows you to send internal messages to other groups or users in your system—a great way to follow up or get quick feedback.

Mobile Functionality

- Client File Data. Access your client files or enter new contacts directly from the mobile app—allowing you to stay connected remotely.

- Click-to-Call. Call your client’s directly from the mobile UGRU CRM for Financial Advisors by clicking on a phone number.

- Opportunities. Manage sales and add new sales opportunities to your new or current contacts remotely.

- Workflows. Manage existing workflows from your mobile device.

- Tasks. View all your pending tasks, task details or enter notes to ensure no actions are missed or forgotten.

- Calendar. View and add calendar items remotely.

Financial Planning

- Integrated Aggregation. In UGRU CRM for Financial Advisors you can feed aggregated client account data from over 10,000 financial institutions directly into your client files. Integrates with Aqumulate™. This gives you more time to build client relationships by eliminating manual data collection.

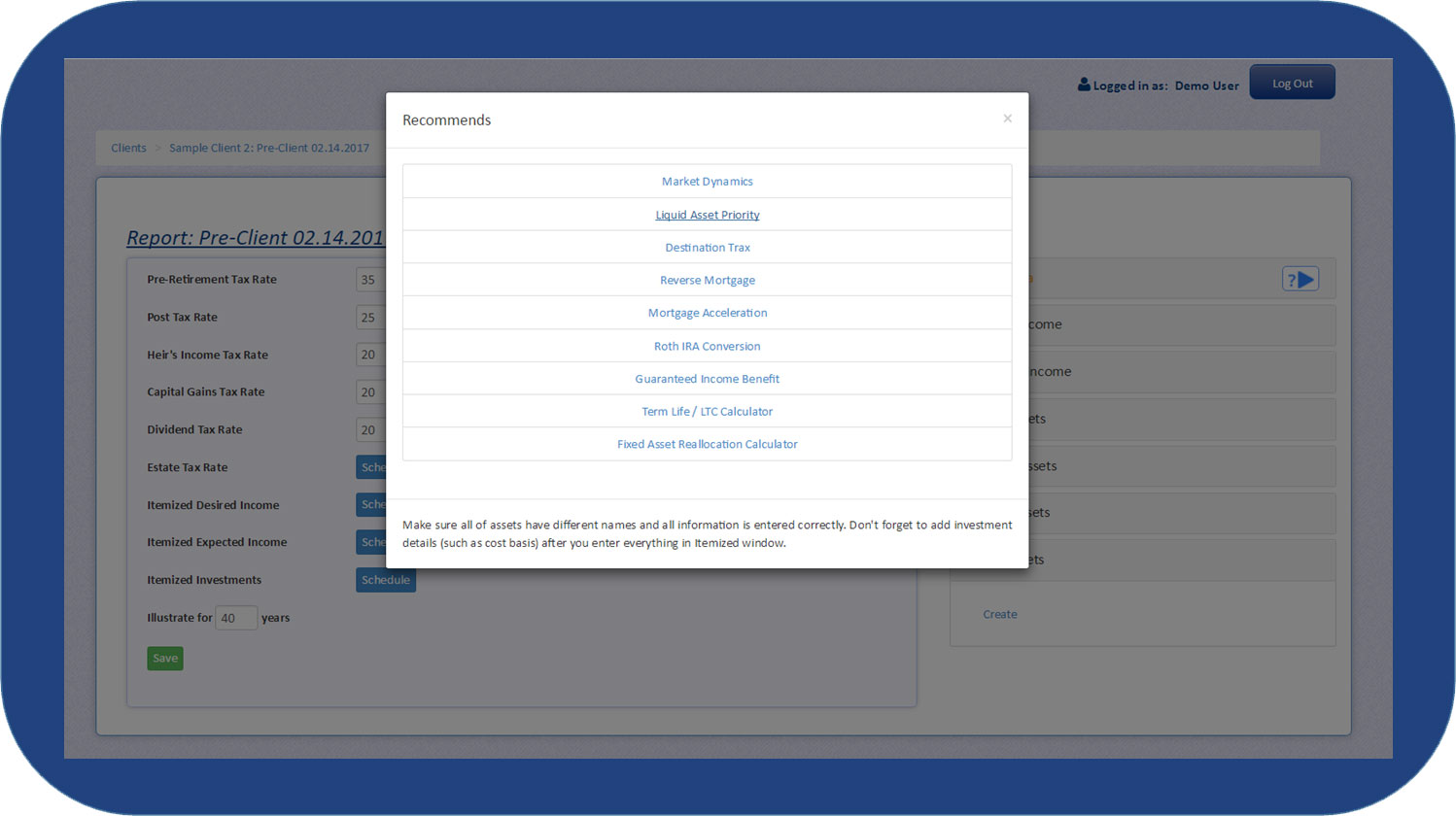

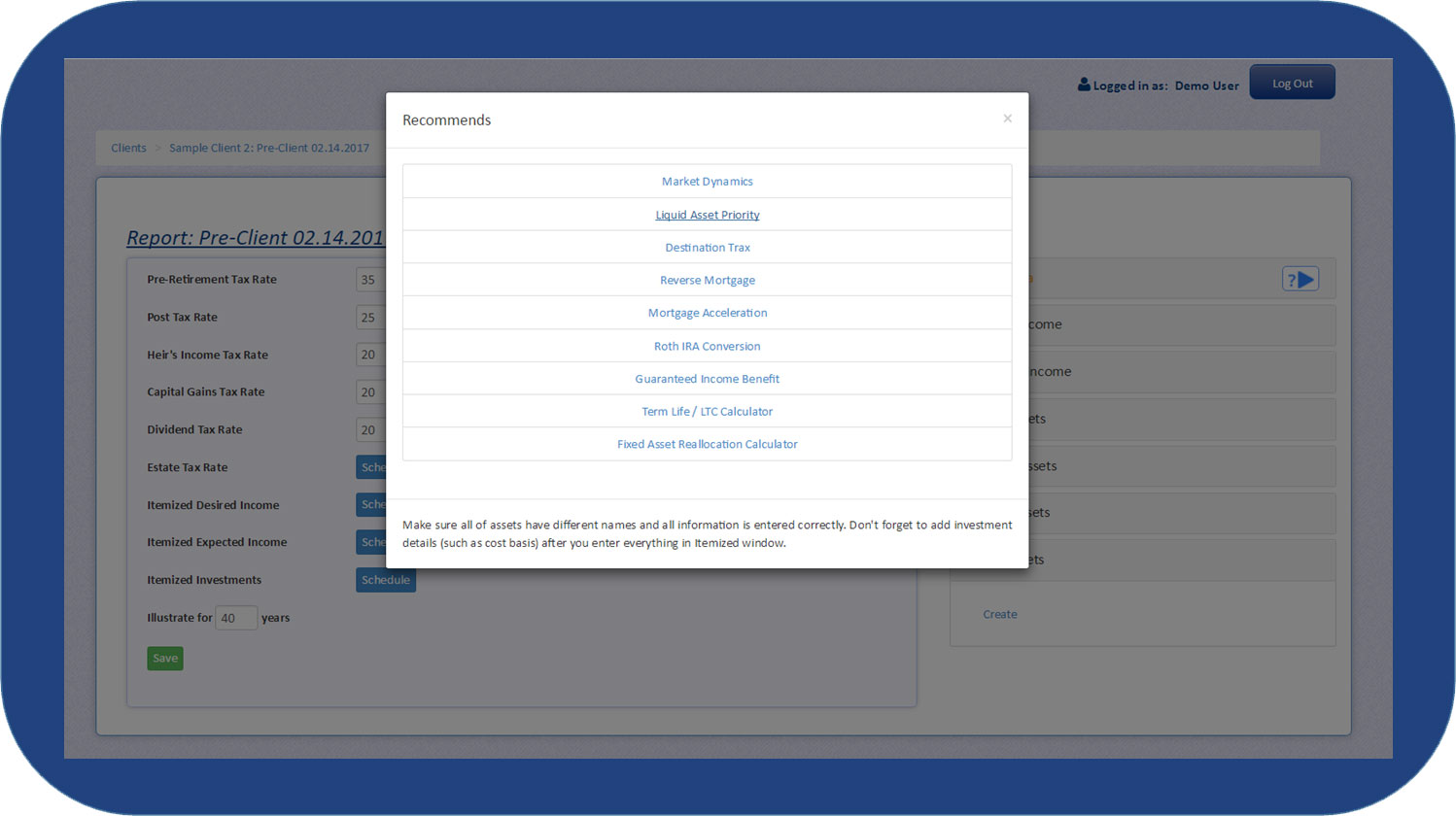

- Decision Center Calculators. These are easy to use calculators for testing and analyzing how common planning strategies will holistically impact a financial plan. Once the value of the strategy has optimized, you can implement it with a single click.

- Social Security Analyzer. A tool to determine when best to start your client’s social security income stream.

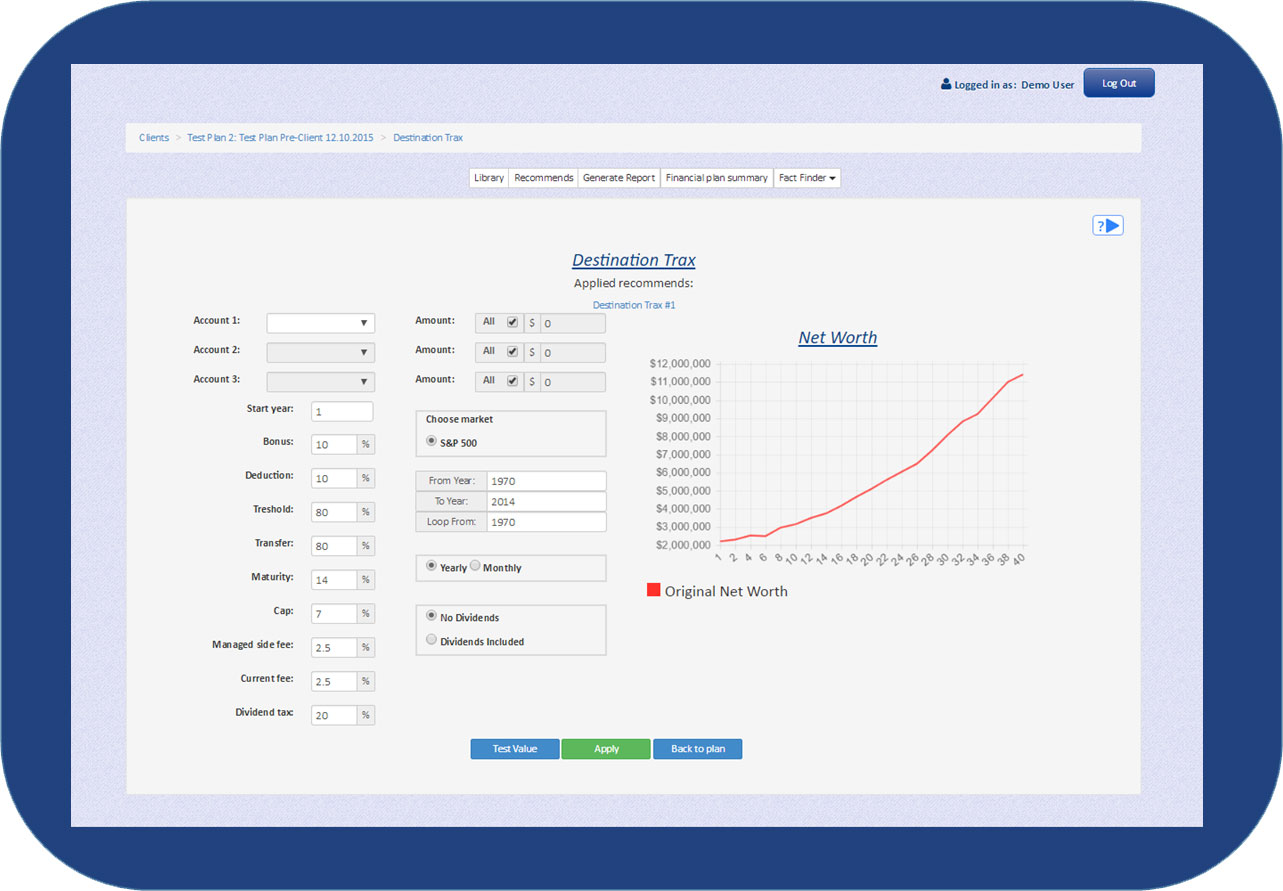

- Market Dynamics. You can use previous stock market periods and the corresponding performance in place of traditionally utilized static returns to stress test your financial plans. Helps you align your client’s future expectations so you can prevent disappointments at annual reviews and reduce client attrition.

- Liquid Asset Priority. This tool optimizes the distribution order of accounts in retirement.

- Destination Trax®. A proprietary investment strategy that incorporates a fixed indexed annuity and an aggressive securities account. Provides a historically proven competitive return with a fraction of the risk and cost to the client.

- Reverse Mortgage. Test for the economic value of performing a reverse mortgage in any year of the plan and identifies required or surplus funds from the implementation to help find the most optimal account.

- Mortgage Acceleration. Tests and applies the benefit of bi-weekly mortgages to the plan.

- Roth IRA Conversion. Test and applies the effect of performing a Roth conversion on any qualified asset account, in any year or over multiple years, and gives you the option to pay taxes out of pocket or from the account itself.

- Guaranteed Income Benefit. Tests the effects of converting any account into an insurance product with a guaranteed income stream.

- Term Life/LTC Calculator. Tests for effects on net worth of implementing a permanent, term life or LTC plan.

- Fixed Asset Reallocation Calculator. Tests the economic effect of reallocating a risky or other asset into something fixed.

- Goal-Based Planning. Allows you to plan for a specific monetary goal over a certain number of years.

- Needs Analysis. Helps determine your client monetary needs through the interview process.

- Cash Flow Planning. Forecasts cash inflows and outflows over several years.

- Estate Planning. Allows you to plan tax-advantaged and protective strategies for the estate to benefit your client’s heirs.

- Advanced Financial Planning. Enables you to create financial plans that incorporates fine details.

- Liquid Assets. Takes into account charitable bequests, “as needed” and “per schedule” distribution choices per account, additional account contribution schedule and excess cash flow reinvestment, 1st and second growth, dividend and turnover assumptions, ability to split an accounts performance into growth and dividend for tax accuracy, considers cost basis, transaction costs, frequency of transactions and what portion of the growth rate is long or short term, accounts for death benefit guarantee, simple or compound GIB payouts, considers exclusion ratios, charitable bequests, illustrates taxable, tax free, tax deferred, equity and unique liquid assets and calculates assets inside or outside the estate.

- Pension Assets. Considers withdrawal limit schedules and corresponding penalties, RMD types (standard, joint table, inherited), stretch illustrations, allows for a delay of required beginning date to age, distinguishes between defined contribution and defined benefit plans, charitable bequests and calculates assets inside or outside the estate.

- Illiquid Assets. Loan illustration and type (amortized or interest only), refinance provisions, sale of asset provision, cost basis, excludable gain, charitable bequests, replacement provision, illustrates primary residence and multiple rental property and calculates assets inside or outside the estate.

- Retirement Income Planning. Planning the risk levels of income providing asset accounts, the optimal distribution method and order, and comfortably ensuring a client’s retirement income.

- Advisor Branded Media. The financial plan report is easily re-brandable so it can contain your own logo and identity.

- Financial Plan Summary. Accounts for all recommendations made in the process of building the financial plan and builds a cover letter for the plan by auto populating template paragraphs that point out the recommendation, why the recommendation was made and the calculated value of that recommendation.

- Third Party Integrations. You can integrate third party apps such as Aqumulate™, Laser App® and Five9® Predictive Dialer. Other integrations are in process.

Security

- FINRA compliance. UGRU CRM for Financial Advisors uses 256-bit encryption and SSAE No. 16 SOC 1 certified (formerly SAS 70 Type II) to ensure confidentiality in communication, automatically journaled emails and backed up data allowing audits to run much more smoothly.

- Highest Encryption Strength. A+ rated TLS encryption ensures the privacy of your data.

- Secure Offsite Data Storage & Backup and Disaster Recovery. Daily backups will ensure no data loss along with redundant off site backup facilities to ensure business continuity in case of emergencies.

- Secure Client Portal. Grant access to your clients to their file manager 24/7. This will help you save time and postage by allowing your client to access their e-documents anywhere, anytime.

- Permissions. Set user permissions to control accessibility to confidential information or system tools to ensure access is restricted to users based on their roles.

- Archiving. All emails and contact data is archived per compliance regulations.

Screenshots