So how does UGRU For Financial Advisors work?

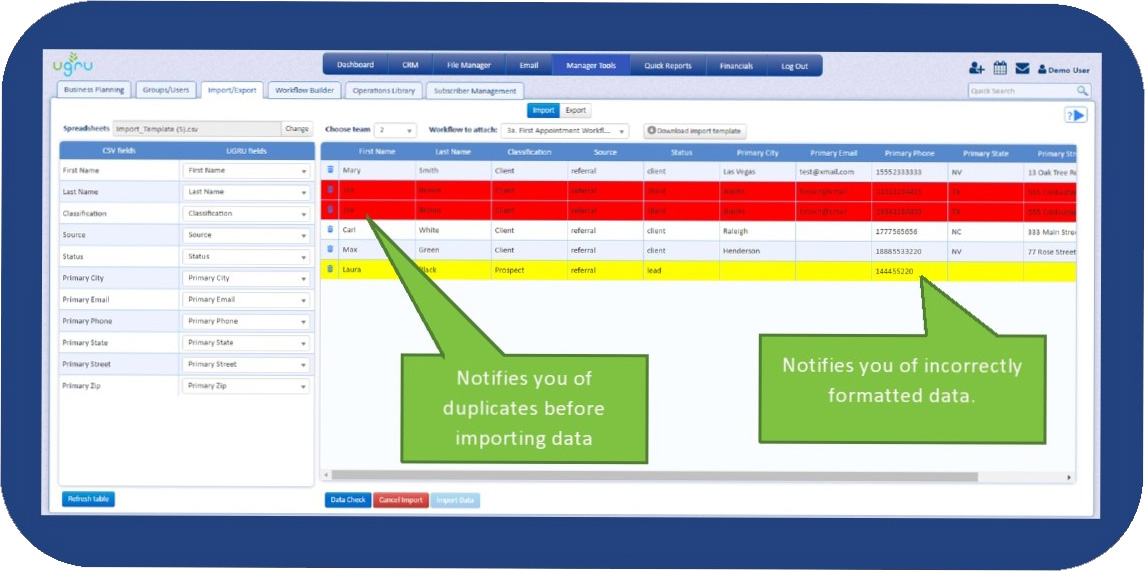

1. Enter your Contacts.

Enter manually or import your existing contacts. The CRM will auto- match fields, check for duplicates and incorrect data making it easy to get started.

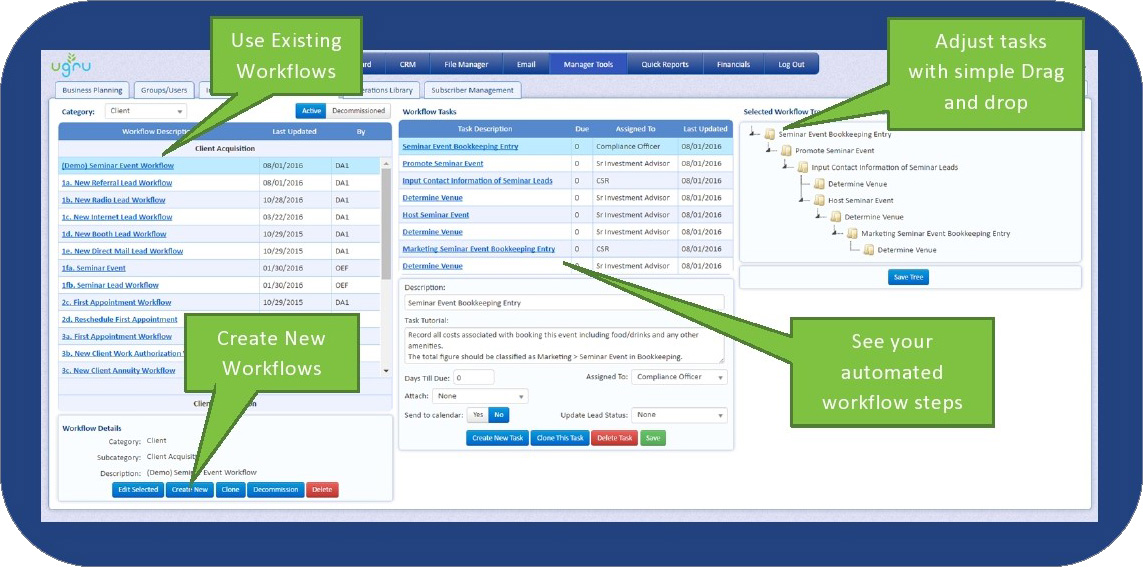

2. Use Workflows to manage operations.

Build workflows from scratch or take advantage of over 40 pre-made and adjustable workflows for Acquisition, Maintenance or Termination of Clients, Staff or Vendors.

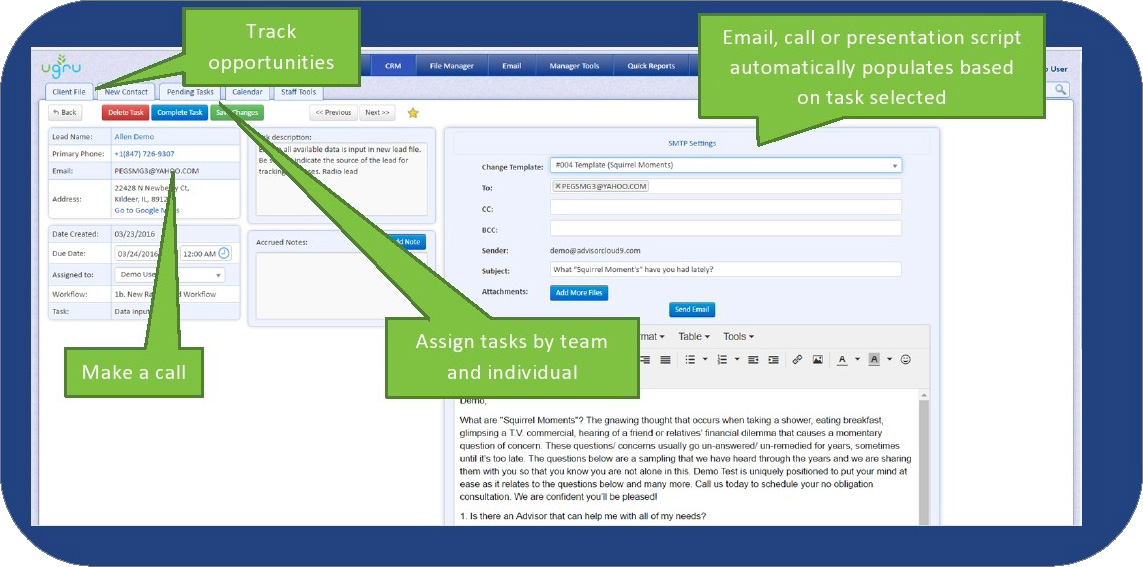

3. Automate your sales process.

Standardize the sales process with workflows, sales scripts, email templates, view your sales pipeline and forecast, and share sales material with the entire team.

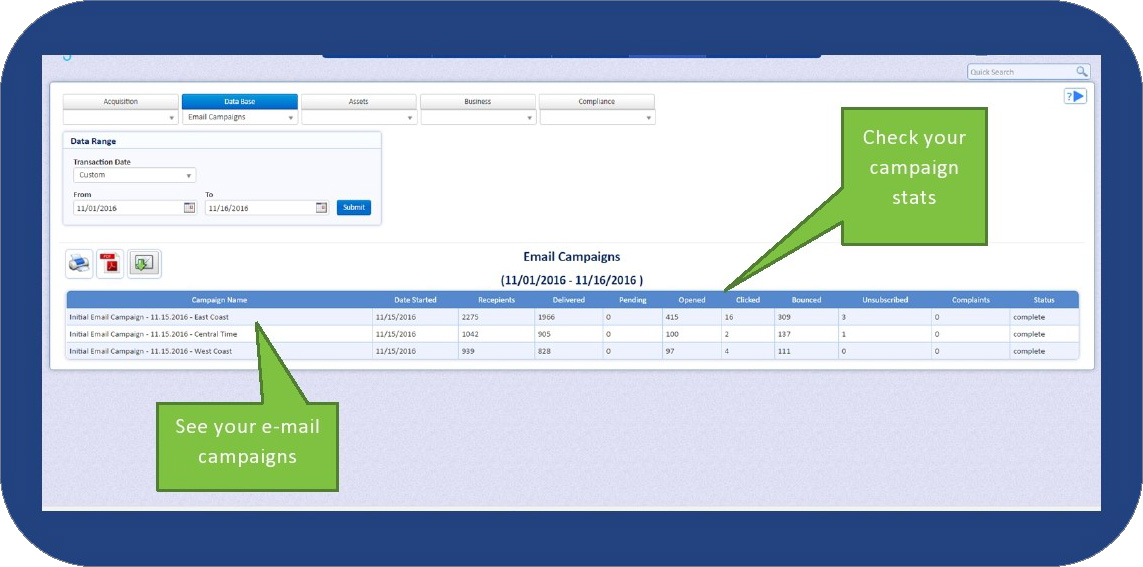

4. Automate your marketing.

Mass email up to 5,000 emails per day and 150,000 emails per month, run drip campaigns and easily view open rates, click through rates, and bounce rates to determine campaign effectiveness.

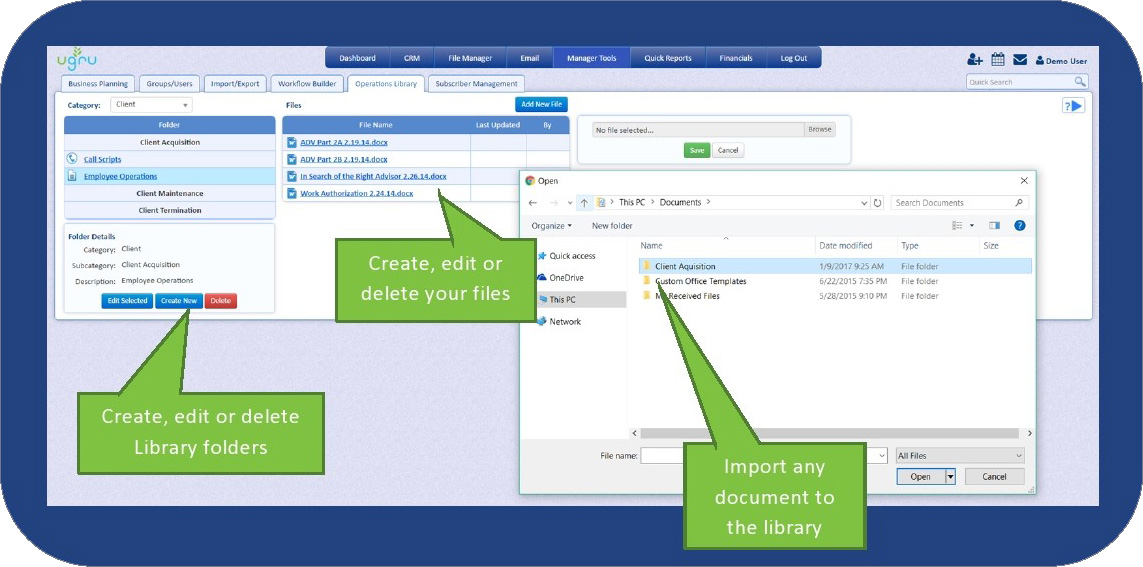

5. Setup the Operations Library.

Organize mission critical documents for utilization in workflows or one-off scenarios like: Call Scripts, HR Word Documents, PDF Contracts or Marketing collateral, Excel, PPT Presentations and Utilize over 100 Tagging Codes to save time on document changes.

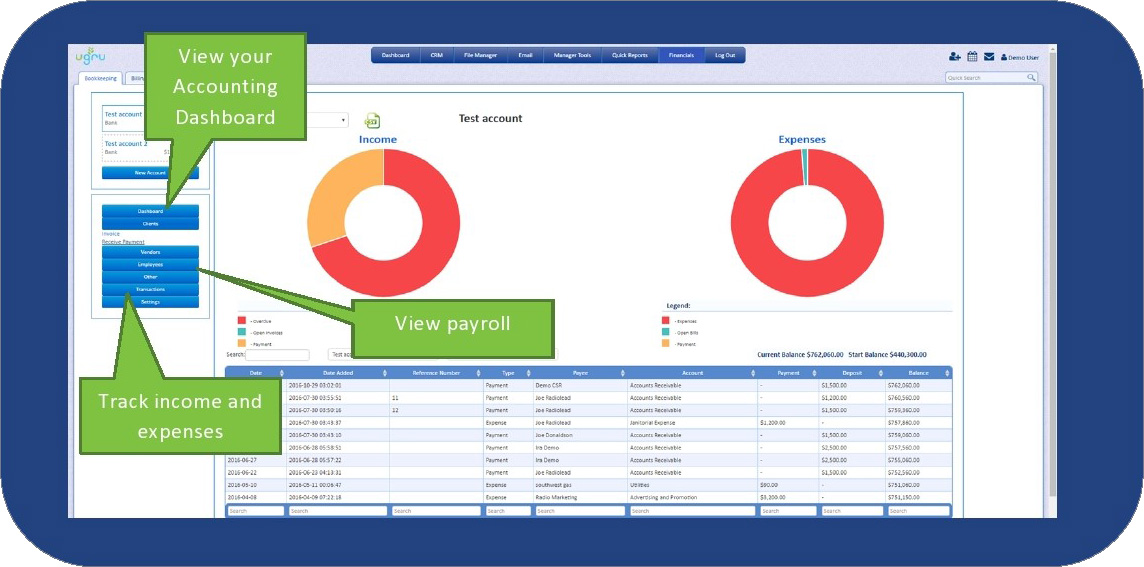

6. Access Built-In Accounting.

Full featured accounting with invoicing, Accounts Receivable, Accounts Payable, General Ledger, plus a financial dashboard, and financial reports (P&L, Balance Sheet, Pipeline reports)—that integrates with other important areas of the CRM.

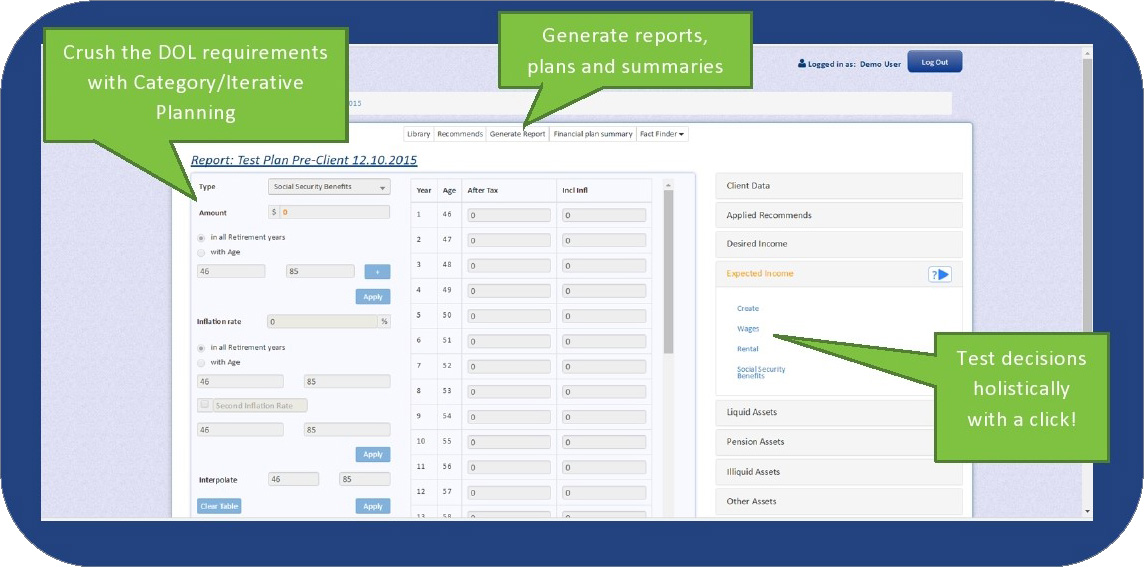

7. Create Quality Financial Plans – Fast.

The “Decision Center” financial calculators will integrate with your CRM to create in half the time high quality plans with the best -in-class financial planning.

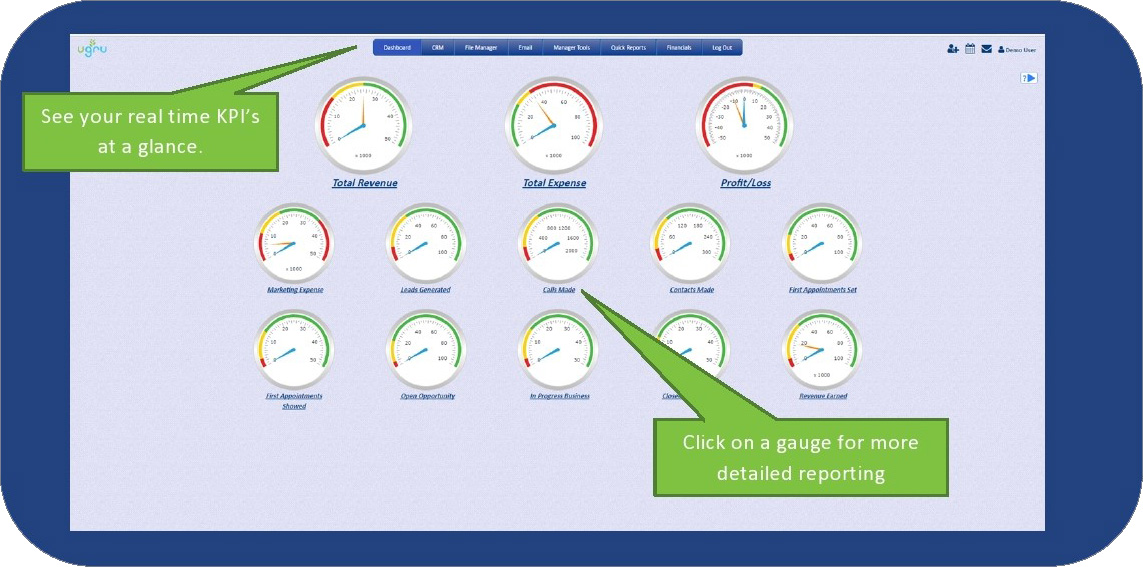

8. Compare REAL vs PLANNED Progress.

View all activity on your integrated dashboard (for your CRM, email, financial planning, marketing, accounting and reporting).