Six main reasons to consider UGRU Financial CRM

1. Full Featured, Integrated Financial CRM

2. Sales Automation

3. Marketing Automation

4. Accounting & Operations

5. The BEST Financial Planning Software

6. Price Performance Leader

Why you should consider UGRU CRM for Financial Advisors?

1. Full Featured, Integrated Financial CRM

2. Sales Automation for Contact & Account Management

UGRU Financial CRM starts with the core contact and follow-up tools to prospect, service, and manage your individual clients and large accounts.

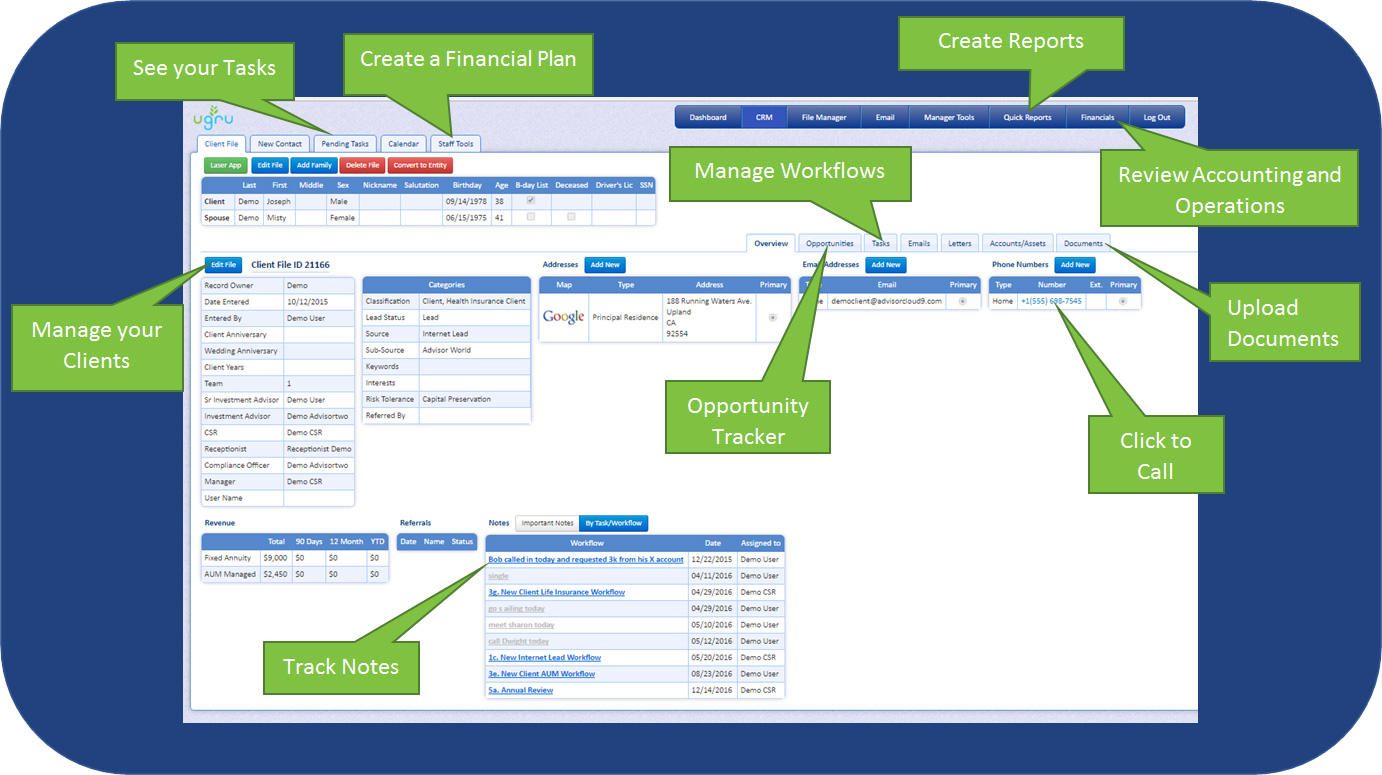

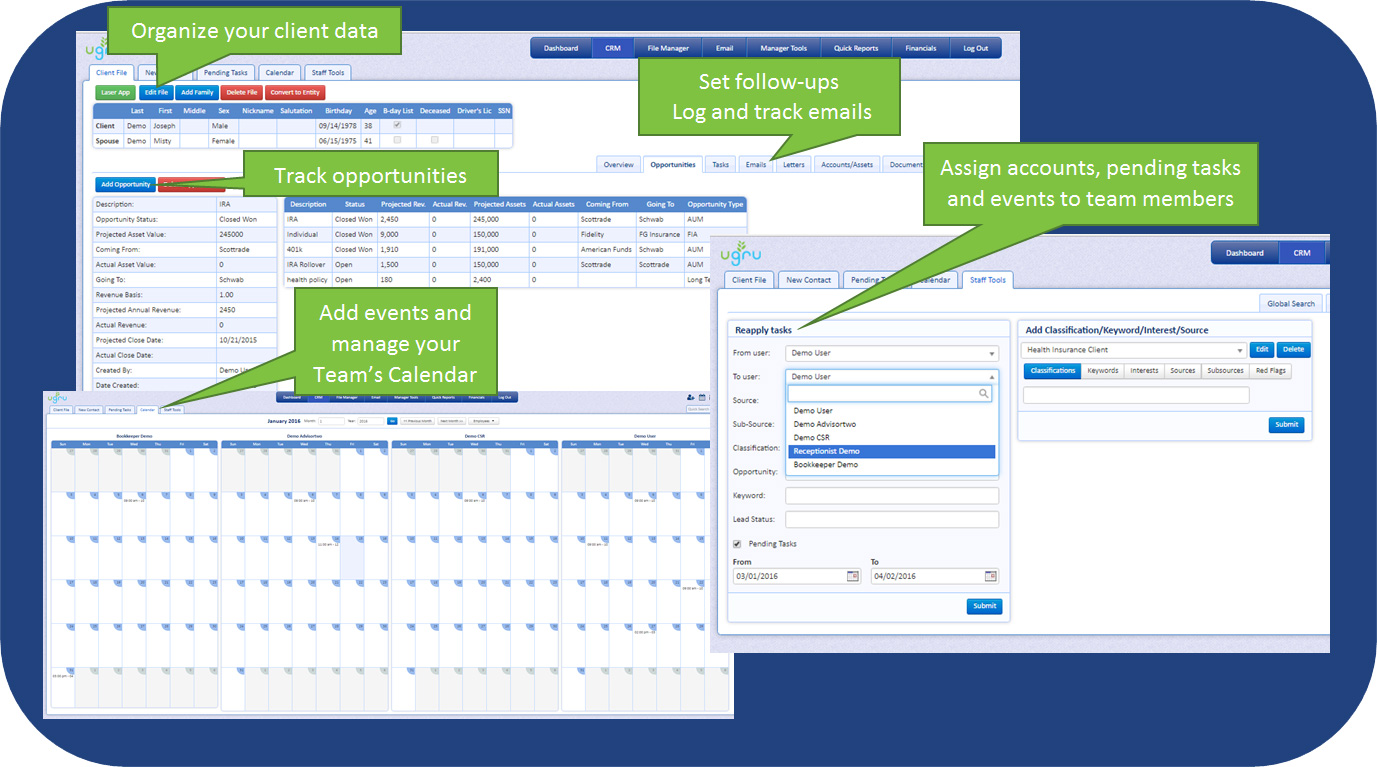

- Contact Management. Capture and organize all of your detailed information for every prospect, client, vendor, and associate, setup follow-up calls and appointments, log emails and detailed notes, setup referrals, and attach documents—everything you need to build your clientele and keep them happy.

- Sales Forecasting and Pipeline. Tracks your contacts, where they are in the sales cycle, the size of the opportunity, whether it is single or recurring revenues, separates AUM and fixed commission opportunities, and calculates the chance of close—making it easy to forecast your sales and cash flow.

- Outbound Phone Automation. Easily connect your VOIP system to call prospects or accounts with a single click, create time-stamped notes, and enable customized call scripts with a consistent sales message for a higher chance of closing.

- Territory Management. Allows you to assign accounts to individuals, groups or territories then easily re-align accounts, pending appointments, task, calendar events, and status to other team members or groups in seconds.

3. Marketing Automation for Financial Planners to get &

retain more clients

Use UGRU Financial CRM to automatically build clients, stay in contact—without all the manual effort—allowing you to do more with a smaller team. Features include:

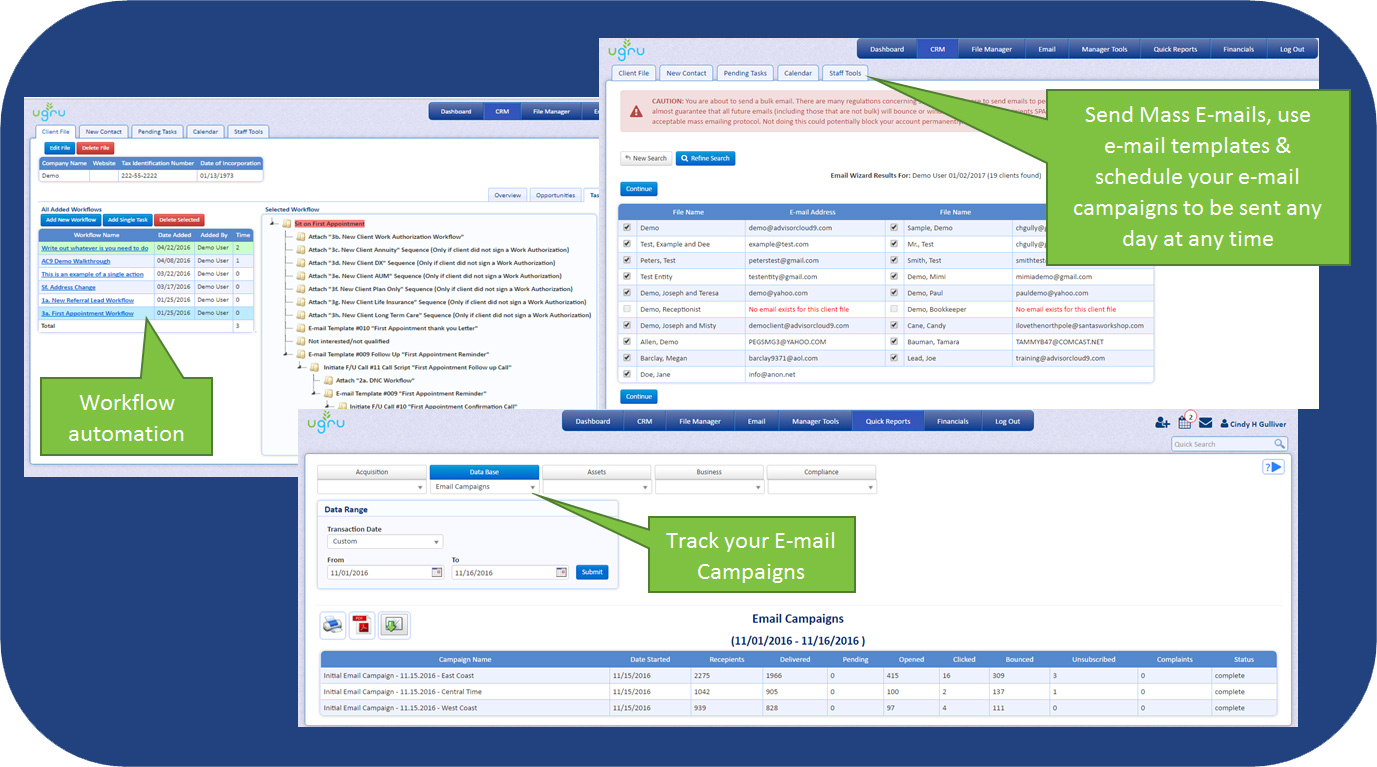

- Mass Email. Create emails, newsletters or updates and send them to multiple contacts (up to 5k/day or 150k/month with just a few clicks). Allows you to prospect new lists, or easily stay connected to your existing clients with account updates, newsletters and financial tips.

- Campaign Analytics. Get open, click through and bounce rates for mass emails and drip campaigns. Helps you determine which marketing activities are the most effective.

- Drip Campaigns. Run automated sequences of emails to any individual or group in your system. This allows you to stay close to your clients regularly and market to prospects automatically without having to do anything outside of the initial setup.

- Workflow Automation. Create your own or edit existing templates to generate tasks and workflows automatically for prospect follow-ups, annual or quarterly client meetings and service items. Creates consistency and ensures client maintenance items do not fall through the cracks, which decreases client turnover through superior customer service.

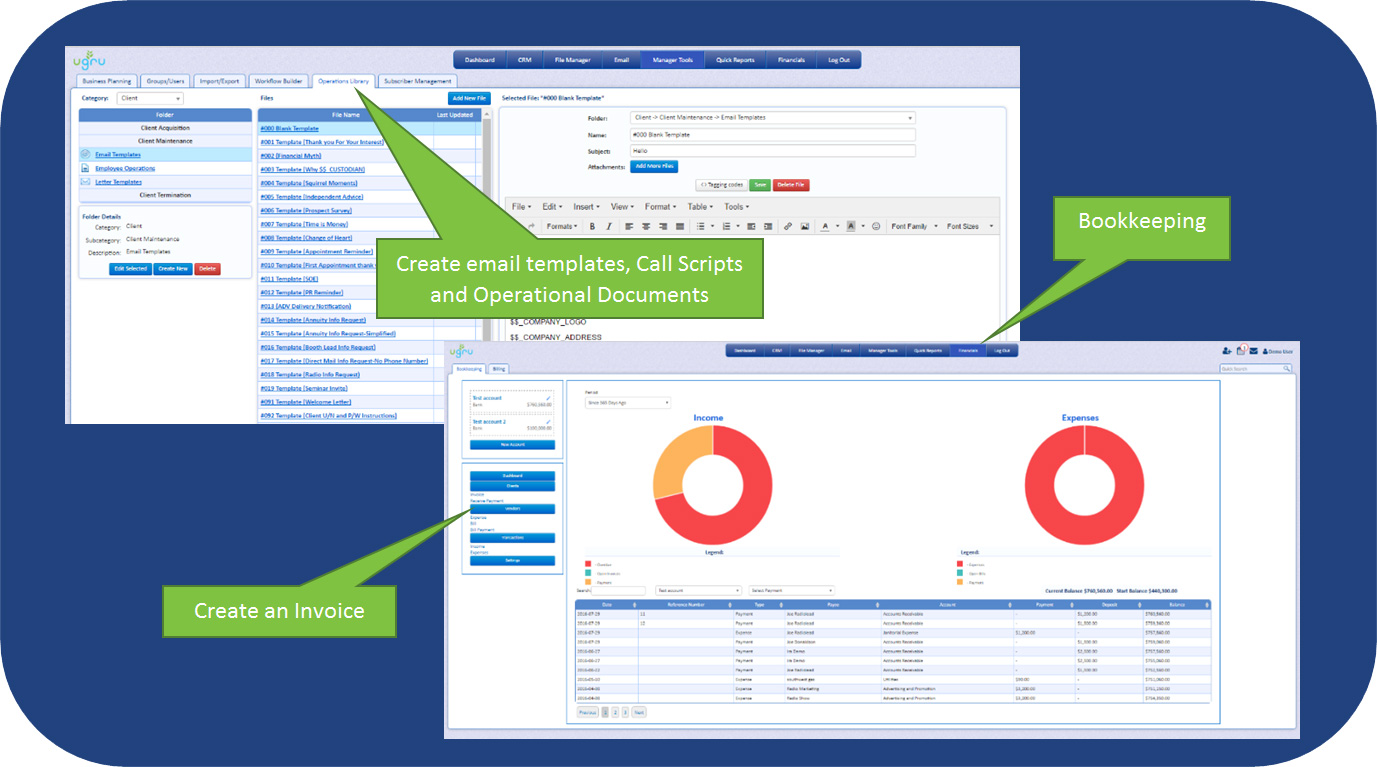

4. Accounting and Operations integrates the entire

business for Financial Advisors

Avoid double or quadruple entry with a central database—including your accounting—making it much easier to bill, follow-up and assess the health of your business, since it’s all integrated. Main features include:

- Full-Featured Accounting. Uses a QuickBooks®- like interface to provide Accounts Receivable, Accounts Payable, General Ledger, Income/Expense Dashboard, Billing, Accrual or Cash Accounting, and unlimited Accounts. Additionally, you can easily run Marketing Analysis, Snapshot, P&L, Balance Sheet, and Pipeline reports that can be converted to spreadsheets, PDF format or emailed with a single click. And best of all—the entire CRM, marketing, and accounting (with easy to manage permissions) is fully integrated and works together.

- Invoicing. Easily and quickly create and send invoices to any contact that is already within the integrated Financial CRM. Making the process easy and helps speed up cash flow.

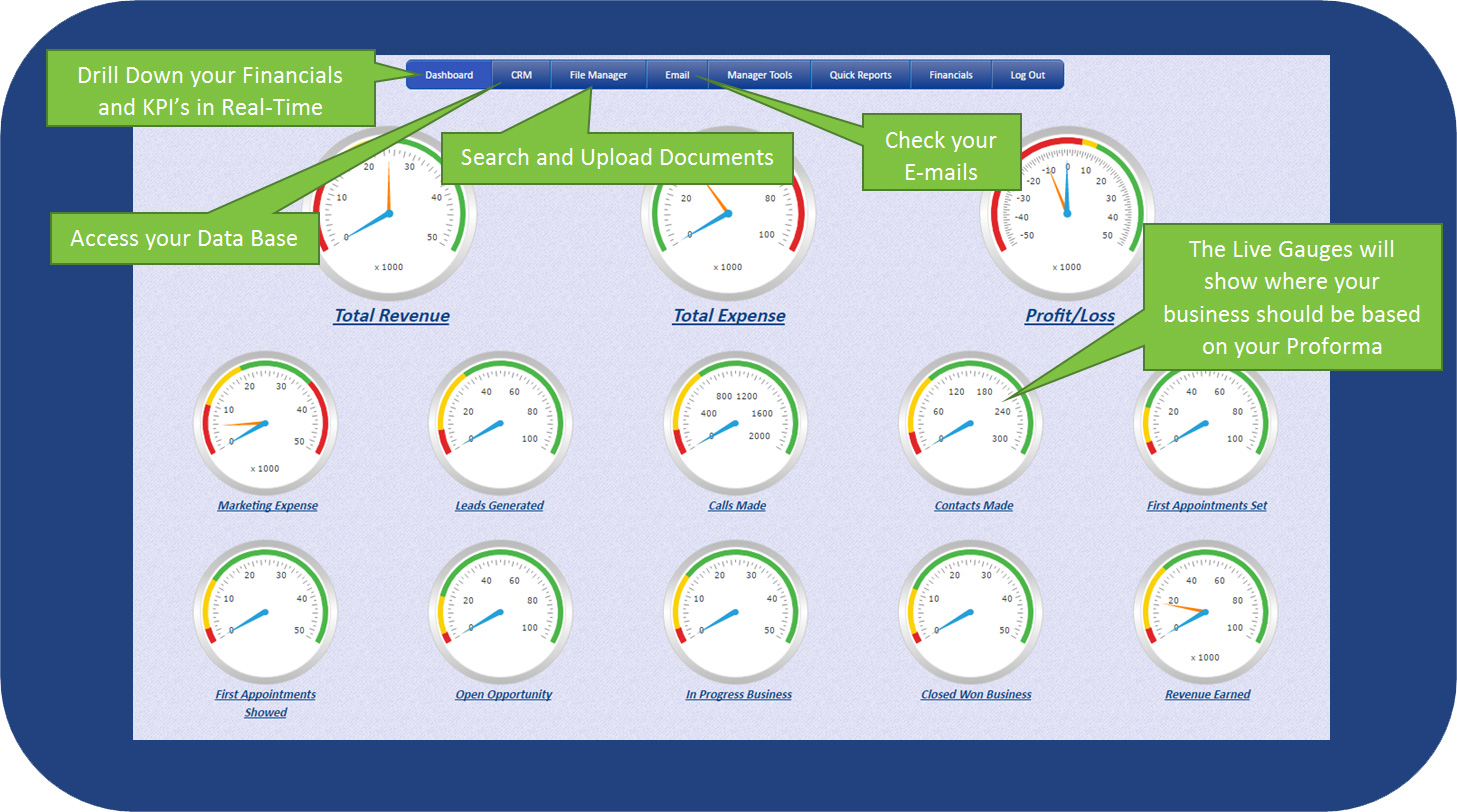

- Financial Dashboard. The financial dashboard makes it easy to drill down and view revenue, expense, and profit/loss along with a quick comparison between firm financial goals and real time results.

- Operations Library. Includes powerful document management for marketing and operational documents, email templates, and call scripts. Includes a built-in editor to create professional templates for both client and prospect marketing and it allows for easy team collaboration on project documents and marketing material.

Important documents like ADVs, portfolio agreements, disclosures or any communication that needs to be sent on a regular basis can be saved with tagging codes that auto-customize for contacts, staff and users.

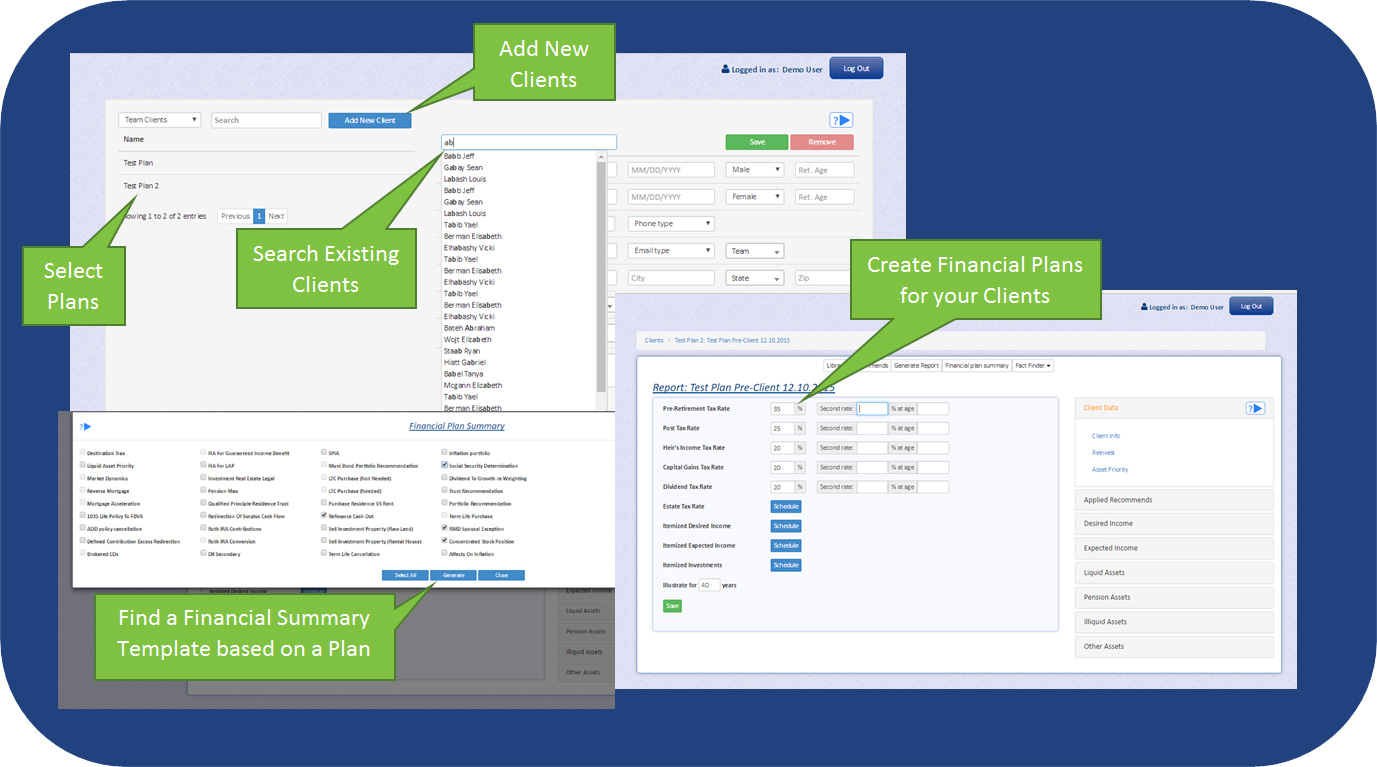

5. The BEST Financial Planning Software.

UGRU Financial CRM has all the features seen in the most popular financial planning applications, plus some found nowhere else.

- Core Features. Goal based planning, needs analysis, cash flow planning, estate planning, advanced planning, investment planning, and retirement income planning. You can also model existing holistic financial pictures and test multiple scenarios using unlimited plan iterations.

Use custom inflation rates for each category of income/expense, take advantage of the Decision Center calculators, and download a fact finder with a single click. You can create fully comprehensive financial plans at a FRACTION of the cost of the competitive alternatives and cut plan creation in half.

In addition, UGRU Financial CRM has financial planning features, some of which are totally unique:

- Decision Center Calculators. Easy to use calculators that analyze how common planning strategies will impact a plan. Includes Roth IRA conversions, optimal income distribution, reverse mortgage, mortgage acceleration, guaranteed income benefit, fixed asset reallocation, and social security analysis. Once the value of the strategy has been analyzed, the user can implement it with a single click!

- Roth IRA Conversion. Test any qualified account using partial or full values for the economic benefit of performing a Roth conversion. Unlike other applications, the user can specify not only which year the execution of the conversion happens, but over how many years the client will spread out the tax cost, and whether to pay those taxes from the qualified account itself or other assets.

- Liquid Asset Priority. Determine the optimal income distribution order of your investment and bank accounts based on taxes, fees, and expected rate of return with just ONE click.

- Reverse Mortgage. Based on the variables input about the primary residence of the client, the user can test the economic value of a reverse mortgage. Surplus dollars or amount needed to fund will automatically be calculated and displayed.

- Market Dynamics. Use either traditional static returns, or Market Dynamics. Market Dynamics replaces the “static” returns commonly used by advisors when constructing financial plans. Apply the full impact of historical market returns to your asset accounts or simulate them with a hedge if the accounts are protected – such as indexed annuities or similar insurance products. Choose whether to include dividends or not and choose which market years you would like to simulate. Testing against market volatility is more realistic for accurate planning.

- Guaranteed Income Benefit. Test any account to see the gain or loss of exercising a guaranteed income benefit - NOT to be confused with simple annuitization which is also testable in the calculator. Choose full or partial values of the account, determine the start year, end year, GIB return, any bonus if applicable on purchasing an insurance product, exclusion ratio, payout start year, and payout amount per year to test the economic impact of the recommendation.

- Destination Trax™. A hybrid investment strategy that couples an aggressive market account with a fixed indexed annuity. The calculator will test to see if this strategy has a positive economic impact on the selected asset account and define what that value is. Destination Trax™ has a proven track record of reducing fees and volatility, and at the same time out-performing the major indices in many economic cycles.

- Financial Plan Summary. Auto-generate an editable full overview word document from pre-built paragraphs based on each of your plan recommendations. This document makes it easy for your clients to understand the numerical plan by putting into plain language your client’s current financial situation, the reasoning for each advisor recommendation, and the value of each recommendation in dollars.

- Money-flow Report. A convenient auto-generated spreadsheet report that easily directs staff to prep all paperwork based on your plan recommendations.

6. Price Performance Leader

UGRU Financial CRM has more value than all other software applications combined, eliminates double entry and sales for a fraction of the cost of the apps it replaces making it the undisputed price performance leader.

- Unified Financial CRM. Eliminates double entry.

- No extra costs. No apps or software to download or install.

- Built in Best Practice Workflow. Increase team performance and Sales. Helps your clients build maximum value.

- Free training. Online training videos, webinars and initial one-on-one training.

- Free Standard Migration.

- Free Basic Setup.